To increase customer safety in cheque payments and reduce instances of frauds occurring on account of tampering of cheque leaves, the Reserve Bank of India announced introduction of Positive Pay System for Cheque Truncation System (CTS) vide its Circular No. DPSS.CO.RPPD.No.309/04.07.005/2020-21 dated 25th September, 2020, advising Banks to implement the same by January 01, 2021.

The concept of Positive Pay involves a process of reconfirming key details of large value cheques. Under this process, the issuer of the cheque submits electronically, through channels like SMS, mobile app, internet banking, ATM, etc., certain minimum details of that cheque (like date, name of the beneficiary / payee, amount, etc.) to the drawee bank, details of which are cross checked with the presented cheque by CTS. Any discrepancy is flagged by CTS to the drawee bank and presenting bank, who would take redressal measures.

How Positive Pay works?To avail this facility, the account holder (drawer of the cheque) needs to share cheque details at the time of issuance of the cheques for amounts of ? 50,000/- and above.

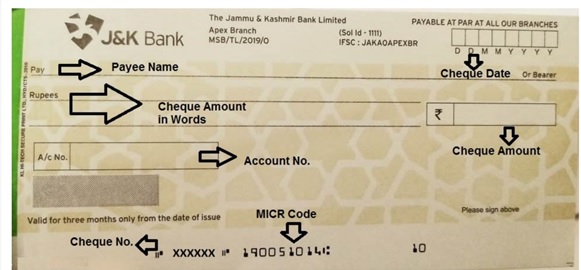

Cheque details to be shared are as under:-

1. Account No. (16-digit Account Number)

2. Cheque/Instrument Number

3. Cheque Date (date mentioned on the cheque

4. Transaction Code (Default)

5. Short A/C No. (Optional/default)

6. Amount on the cheque*

7. Payee Name*

8. MICR (Drawee Routing No.)*

What are the channels for J&K Bank Positive Pay System?

The following channels can be used by customers for J&K Bank Positive Pay System:-

1.

Internet Banking

2.

Mobile Banking (mPay 6) /mPay Delight

It is not mandatory to use Positive Pay System. However, cheques issued at a value greater than Rs 50,000 shall be accepted for dispute resolution mechanism under CTS grid only if Positive Pay facility is used by the account holder.

If Positive Pay is not used by the account holder, will the cheque be processed?Yes, the cheque will be processed in normal mode even if the account holder do not use Positive Pay. However, any issue in relation to the cheque will not be accepted for dispute resolution mechanism under Cheque Truncation System (CTS) grid by NPCI.

Are there any service charges for using the J&K Bank Positive Pay facility?No, Positive Pay facility is provided free of charge to all customers on e-banking & mobile banking (mPay delight) platforms.

What if there is a mistake made while entering details of cheques issued in Positive Pay?In case of any mismatch while entering details in PPS, J&K Bank has the right to return the cheque.

What are the steps for using Positive Pay on Internet Banking?- Login into J&K Bank’s e-banking portal: https://www.jkbankonline.com/

- For submission of PPS data, go to General Services -> Positive Pay -> PPS Entry

- On the PPS request entry page fill the cheque/instrument related details. Internet Banking validates cheque status, cheque should be unused

- Enter the Transaction password and OTP and then click on SUBMIT button.

- Login into J&K Bank’s mPAY Delight App.

- For submission of PPS data, click on “PPS Cheque Validation” Menu on the dashboard and click on the “PPS Cheque Entry” option.

- Select the Account Number from the drop down menu. After selecting the account number, enter valid six digit cheque number and click on the “SUBMIT” button. Mobile banking validates cheque status, cheque should be unused

- Enter Cheque PPS details (Instrument Date, Amount, Payee Name and Drawee Routing Number) on the PPS Cheque Entry Page and click on “SUBMIT” button.

- If cheque details are valid, successful message will be displayed on the screen.

For multiple cheques, separate Positive pay entry is to be done for each cheque.

What are the flags used by NPCI for PPS?

Flag |

Description as per NPCI |

Explanation |

P |

Instrument validated with PPS No. mismatch in Cheque number, Drawee bank MICR and Amount |

PPS details match with CTS data |

D |

Duplicate instrument already presented. No mismatch in Cheque No, Drawee bank MICR and Amount |

Instrument already presented, duplicate record |

Y |

Amount Mismatch. Cheque number and Drawee bank MICR have matched with PPS |

Amount on cheque & PPS do not tally, other details match vic. Cheque no. & MICR |

Z |

Duplicate instrument already presented. Amount mismatch. Cheque no and Drawee bank MICR matched |

Amount/Payee do not match, instrument already presented with PPS mismatch |

N |

Instrument not part of PPS data |

No PPS record found, cheque no. not present |

Important Points to note:

- Positive Pay System is enabled for all account holders and is option for customers to update details of cheques of Rs.50000/- and above.

- In respect of cheques issued for an amount of INR 5.00 lakh and above, we strongly recommend our account holders to update the cheque details in J&K Bank Positive Pay System, as advised herein above.

- Customers are advised to feed correct details of the cheque including correct spelling of payee’s name and the exact amount of the cheque to the Bank for successful positive pay confirmation. There is no option for Modify/Delete confirmation in any mode because modification could not take place once the data will be submitted to NPCI. Bank will not be responsible for any incorrect information provided by a Customer.

- In case of mismatch in details on the cheque with the details uploaded under the PPS system, if otherwise in order viz. sufficient funds, signature match etc., Bank shall, at its sole discretion, return the cheque with the remarks “REFER TO DRAWER”, at the sole risk, responsibility and liability of the Customer.

- If no data is uploaded under Positive Pay System by the Customer, such cheques issued will still be cleared in a normal mode as per extant guidelines. However the account holder shall be solely responsible in such cases for any discrepancies and will not be able to raise any dispute over any undue clearance or return and the Bank will not be liable for any such development.

- As per Reserve Bank of India directions, only those cheques which are entered in the Positive Pay System and are compliant with above instructions will be accepted under dispute resolution mechanism at the CTS grids.

- The confirmation of successful or unsuccessful update on PPS is provided by NPCI and information of the same will be shared with the customer accordingly.

- Cheques presented in Clearing are validated as per the regulatory guidelines defined for CTS Clearing. PPS system is an additional tool for validation of cheques. All other parameters with respect to validation of Cheques remain unchanged.

- The Bank shall not be responsible for any losses or delays which may be caused by any circumstances beyond its control, or for any act, omission, neglect, default, failure or insolvency of any correspondents, agents or their employees or any third party systems.

- For any further clarifications, please feel free to call on toll free no. 1800 890 2122 or put your query to tndd@jkbmail.com or visit your nearest J&K Bank branch.

Recharge

Recharge Pay Bills

Pay Bills Fee Collections

Fee Collections Pay Taxes

Pay Taxes