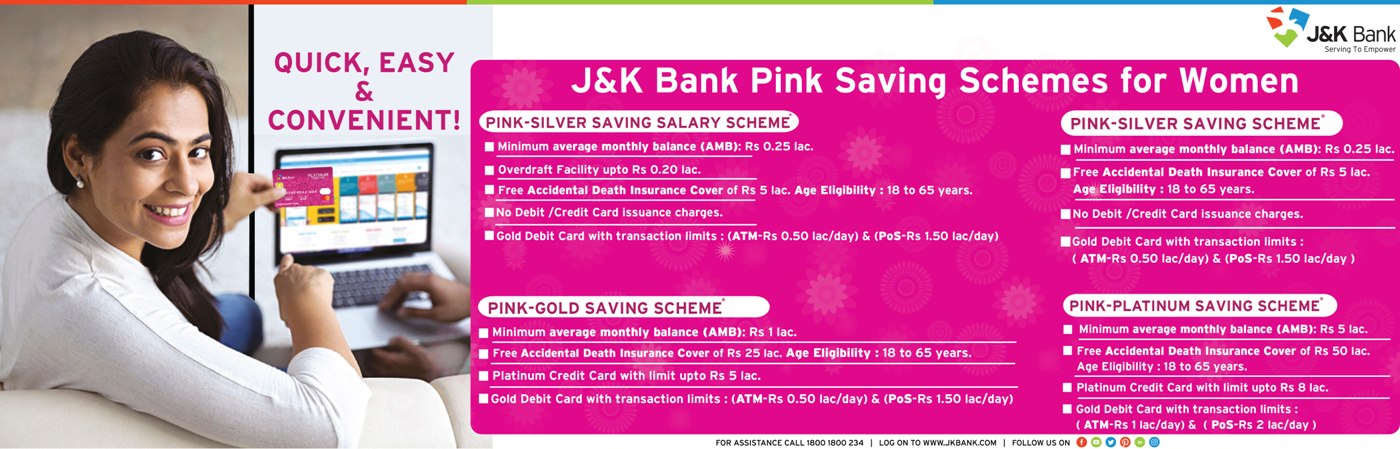

- Minimum Average Monthly Balance (AMB)

- Rs.500000=00 (Rs.Five lacs)

AMB Non-maintenance Charges Per Month Rs.2500/= Plus GST per month - Cash Withdrawal at Business Unit

- 5 withdrawals per month free

Thereafter Rs.20.00 shall be charged per cash withdrawal - Cash Deposit Charges

- Base Business Unit free

Non-Base Business Unit : - Up to Rs.10 Lacs or 5 transactions free

- Thereafter normal service charges shall be recovered.

- Debit Card Issuance Charges

- Free

- Annual / renewal Free

- Gold Debit Card transaction limits per day

- ATM (cash withdrawal) Rs.100000/=

POS / Merchant Usage Rs.200000/= - Gold Debit Card Usage Charges

- 30 transactions per month Free (On-Us)

05 transactions per month Free (Off-Us) - Credit Card

- Platinum Credit Card with limit up to Rs.800000/= (Rupees Eight Lacs) subject to eligibility.

Credit Card Issuance charges Nil - Locker Rent

- One medium / small size locker free (subject to availability of lockers)

- Cheque Book

- Free

- Demand Draft unlimited

- Free

- Payment Orders unlimited

- Free

- Cheque Collection Charges

- Free

- Insurance Cover:

- Free Accidental Death Insurance Cover of Rs.5000000.00 Lacs (Rupees Fifty Lacs only).

- Age eligibility for accidental death insurance cover:

- 18 to 65 years

- Minimum Average Monthly Balance (AMB)

- Rs.100000=00 (Rs.One lacs)

AMB Non-maintenance Charges Per Month Rs.700/= Plus GST per month - Cash Withdrawal at Business Unit

- 5 withdrawals per month free

Thereafter Rs.20.00 shall be charged per cash withdrawal - Cash Deposit Charges

- Base Business Unit free

Non-Base Business Unit : - Up to Rs.3 Lacs or 3 transactions free

- Thereafter normal service charges shall be recovered.

- Debit Card Issuance Charges

- Free

- Annual / renewal Free

- Gold Debit Card transaction limits per day

- ATM (cash withdrawal) Rs.50000/=

- POS / Merchant Usage Rs.150000/=

- Gold Debit Card Usage Charges

- 30 transactions per month Free (On-Us)

05 transactions per month Free (Off-Us) - Credit Card

- Credit Card Issuance charges Nil

Platinum Credit Card with limit up to Rs.500000/= (Rupees Five Lacs) subject to eligibility. - Locker Rent

- 50% Rebate on rent of One Small Size Locker (Subject to availability of Lockers).

- Cheque Book

- 200 leaves per annum: Free.

Thereafter normal service charges shall be recovered. - Demand Draft unlimited

- Rs.5000000/= (Rupees Fifty Lacs) per month Free.

- Payment Orders

- 30 numbers Free per month

- Cheque Collection Charges

- Free

- Insurance Cover:

- Free Accidental Death Insurance Cover of Rs.2500000.00 Lacs (Rupees Twenty five Lacs).

- Age eligibility for accidental death insurance cover:

- 18 to 65 years

- Minimum Average Monthly Balance (AMB)

- Rs.25000=00 (Rs.Twenty Five Thousands)

AMB Non-maintenance Charges Per Month Rs.100/= Plus GST per Rs.5000/= or Rs.500/= whichever is lower. - Cash Withdrawal at Business Unit

- 5 withdrawals per month free

Thereafter Rs.20.00 shall be charged per cash withdrawal - Cash Deposit Charges

- At Base Business Unit as well as Non-Base Business Unit :

- Five transactions or Rs.10.00 Lacs per month (Maximum)

- Thereafter normal service charges shall be recovered.

- Debit Card Issuance Charges

- Nil for First Card

- Annual / renewal fee as per existing guidelines

- Gold Debit Card transaction limits per day

- ATM (cash withdrawal) Rs.50000/=

POS / Merchant Usage Rs.150000/= - Gold Debit Card Usage Charges

- 15 transactions per month Free (On-Us)

05 transactions per month Free (Off-Us) - Credit Card

- Credit Card Issuance charges Nil

- Cheque Book

- Free 50 leaves per annum

Thereafter normal service charges shall be recovered. - Demand Draft Issuance Charges

- Nil up to Rs.1000000/= (Rupees Ten Lacs) per month

- Payment Orders

- 10 numbers Free per month

- Cheque Collection Charges

- Free

NEFT/RTGS (initiated by the customer through E-banking & M-pay Free)

Free - Insurance Cover:

- Free Accidental Death Insurance Cover of Rs. 500000.00 Lacs (Rupees Five Lacs).

- Age eligibility for accidental death insurance cover:

- 18 to 65 years

- Minimum Average Monthly Balance (AMB)

- Rs.25000=00 (Rs.Twenty Five Thousands)

AMB Non-maintenance Charges Per Month Rs.100/= Plus GST per Rs.5000/= or Rs.500/= whichever is lower. - Cash Withdrawal at Business Unit

- 5 withdrawals per month free

Thereafter Rs.20.00 shall be charged per cash withdrawal - Cash Deposit Charges

- At Base Business Unit as well as Non-Base Business Unit :

- Five transactions or Rs.10.00 Lacs per month (Maximum)

- Thereafter normal service charges shall be recovered.

- Overdraft Facility

- 50% of net salary drawn (Maximum Rs.20000/-) Rs.Twenty Thousand)

- Debit Card Issuance Charges

- Nil for First Card

- Annual / renewal fee as per existing guidelines

- Gold Debit Card transaction limits per day

- ATM (cash withdrawal) Rs.50000/=

POS / Merchant Usage Rs.150000/= - Gold Debit Card Usage Charges

- 15 transactions per month Free (On-Us)

05 transactions per month Free (Off-Us) - Credit Card

- Credit Card Issuance charges Nil

- Cheque Book

- Free 50 leaves per annum

Thereafter normal service charges shall be recovered. - Demand Draft Issuance Charges

- Nil up to Rs.1000000/= (Rupees Ten Lacs) per month

- Payment Orders

- 10 numbers

- Cheque Collection Charges

- Free

- NEFT/RTGS (initiated by the customer through E-banking & M-pay Free)

- Free

- Insurance Cover:

- Free Accidental Death Insurance Cover of Rs. 500000.00 Lacs (Rupees Five Lacs).

- Age eligibility for accidental death insurance cover:

- 18 to 65 years

Recharge

Recharge Pay Bills

Pay Bills Fee Collections

Fee Collections Pay Taxes

Pay Taxes